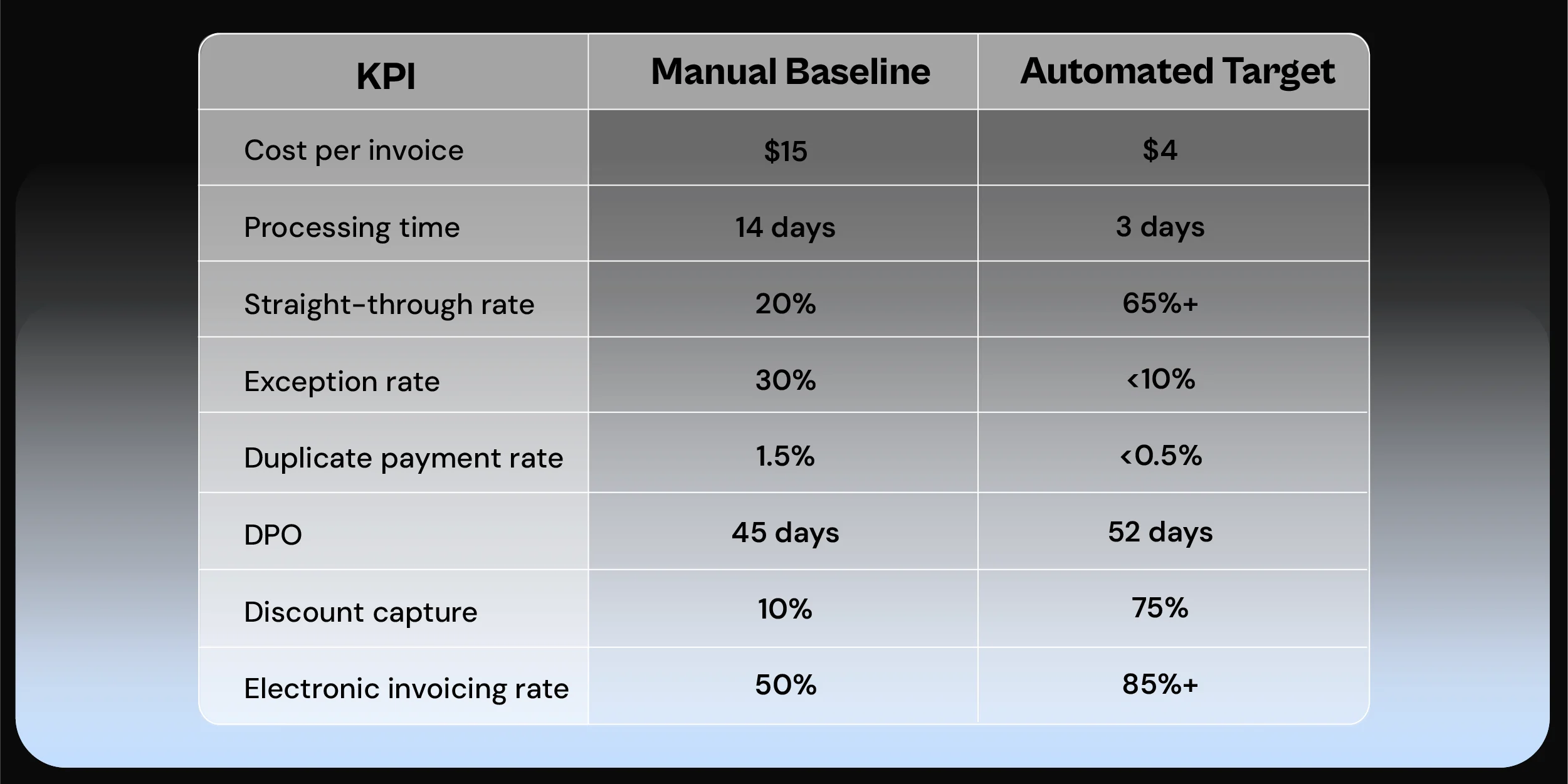

The KPIs That Matter Most

1. Cost Per Invoice

Manual: $10–$15 | Automated: $2–$4

This is the most direct metric: what it costs to process a single invoice from receipt to payment.

Tip: Include software, headcount, exception handling, and audit time in your cost model.

2. Invoice Processing Time

Manual: 14–18 days | Automated: 3–5 days

Faster processing unlocks better cash flow decisions. It also means fewer late fees and more early-payment discounts.

3. Straight-Through Processing Rate

Manual: ~20% | Best-in-Class: >60%

This tracks what percentage of invoices are processed without human intervention.

Target: 65%+ straight-through after 12 months of automation.

4. Exception Rate

Manual: 20–40% | Automated: <10%

Every exception adds time, cost, and risk. Tracking and reducing exception volume is key to scaling.

5. Duplicate Payment/Error Rate

Goal: <0.5% of payments

Invoice errors, duplicates, or wrong amounts create unnecessary leakage. Automation with 3-way matching can reduce this significantly.

Strategic Metrics for CFOs

6. Days Payable Outstanding (DPO)

Top-performing automated AP teams often gain 3–7 days in DPO, improving cash flow.

Example: Increasing DPO from 45 to 52 days = ~$1M in additional working capital on $50M AP volume.

7. Early-Payment Discount Capture Rate

Manual: <10% | Automated: 60–80%

With faster approvals and payment scheduling, you can actually capture those 1–2% early-pay discounts.

8. % of Electronic Invoices

Manual: ~50% | Target: 85%+

A sign of supplier onboarding success and digital maturity.

9. Payback Period / ROI

Best-in-class AP automation delivers ROI within 12–18 months.

Tip: Include cost savings, discount capture, reduced errors, and team reallocation in your ROI model.

Sample KPI Dashboard

Automation is only as good as the outcomes it drives. For CFOs, tracking the right KPIs ensures automation delivers real ROI, not just faster workflows but smarter financial control.

Book a demo to see how Finofo helps CFOs measure and maximize automation ROI in one unified platform.