Scale payables without increasing headcount.

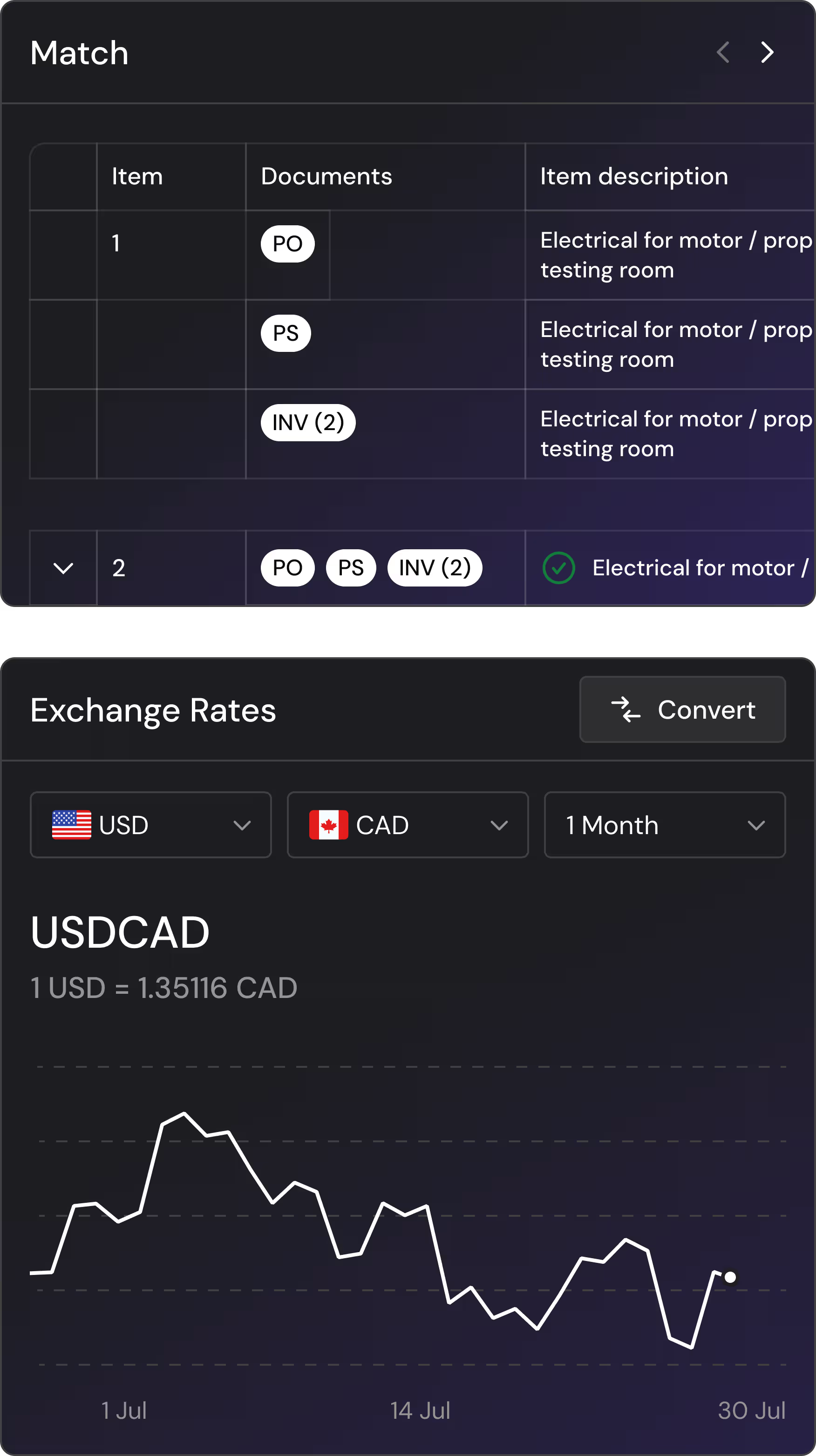

Ingest invoices instantly from any channel, match POs at the line level, route approvals automatically, and post to your ERP with AI-assisted coding.

Move from draft → approved → paid in one unified flow — accurate, auditable, and ERP optional.

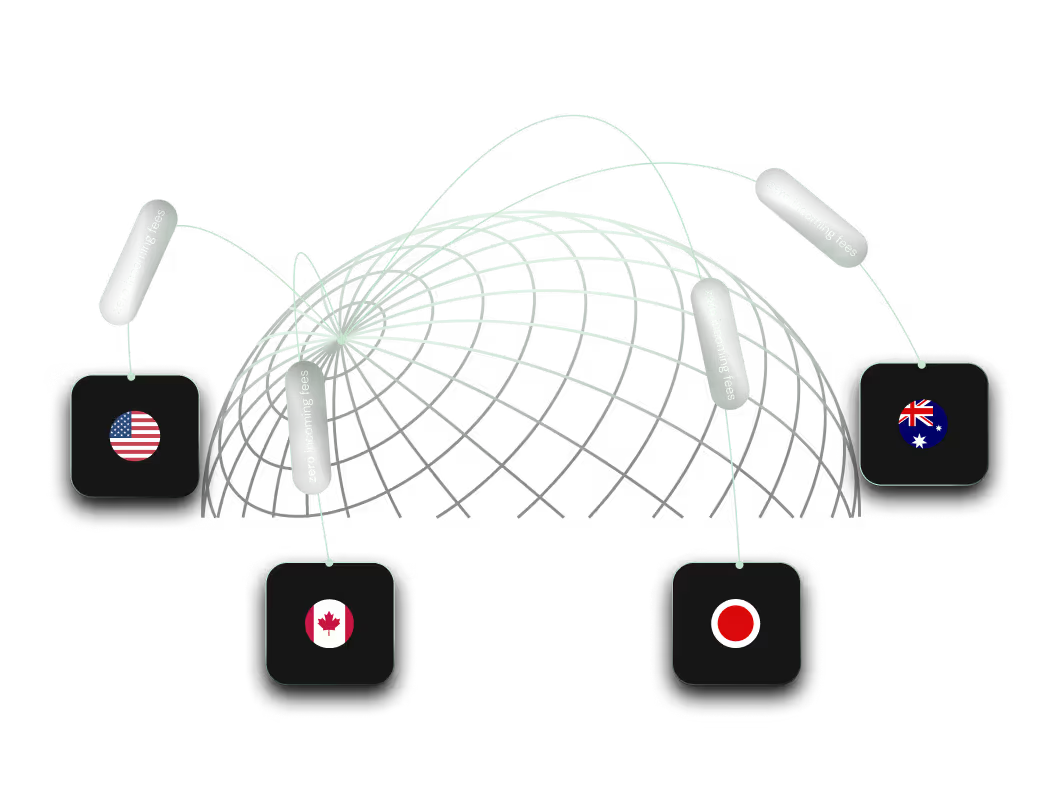

Pay suppliers in 190+ countries through local rails with one click.

No SWIFT delays, no wire fees, no manual reconciliation — just fast, secure global payouts with complete audit trails.

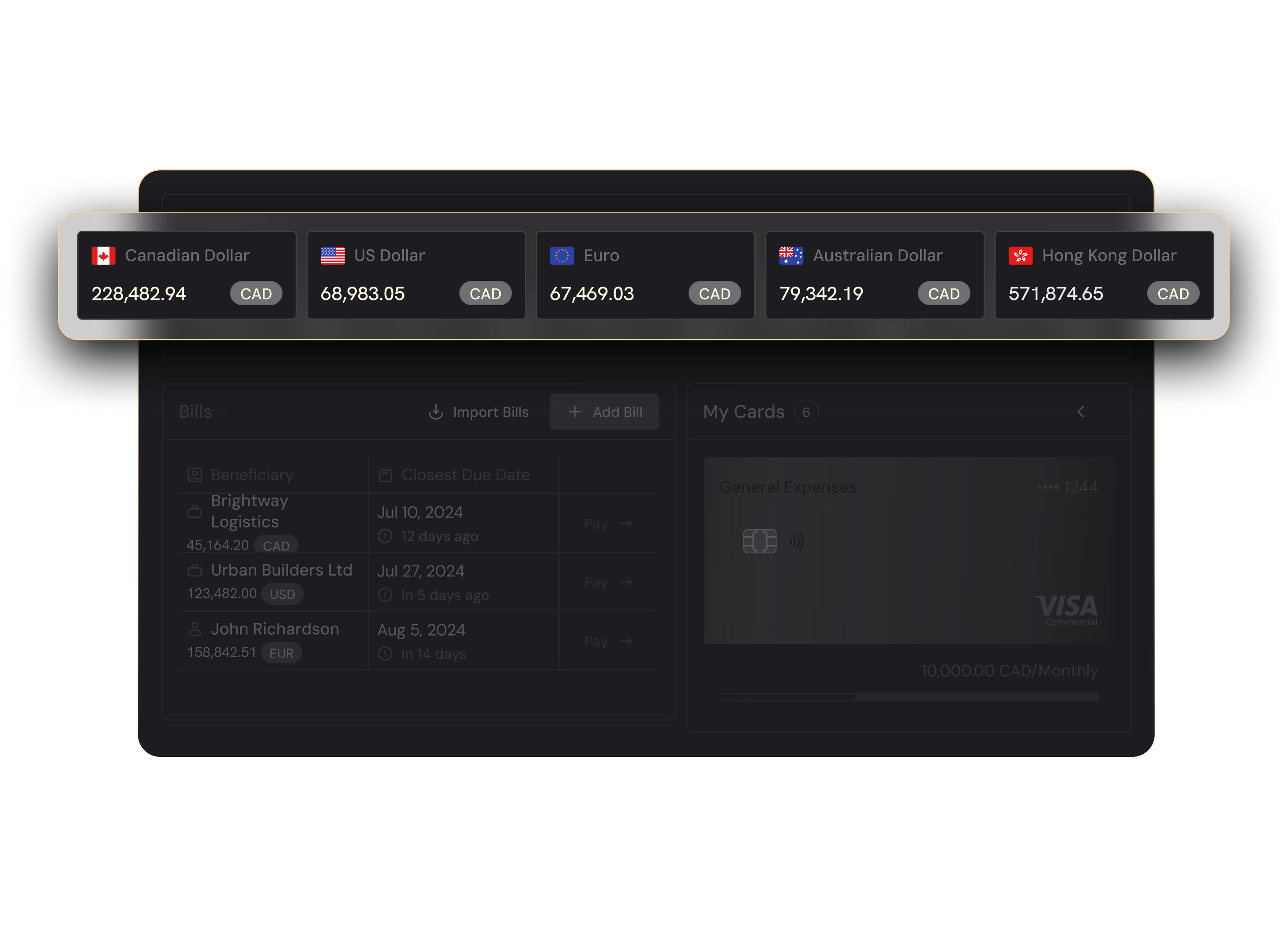

Open dedicated global accounts in 15+ currencies and collect like a local.

Improve cash flow, reduce FX losses, and give your Treasury team predictable visibility across regions.

View real-time balances, liabilities, FX exposure, and vendor payments from a single dashboard.

Switch between entities instantly and manage global cash with confidence — without exporting spreadsheets or stitching data from multiple systems.

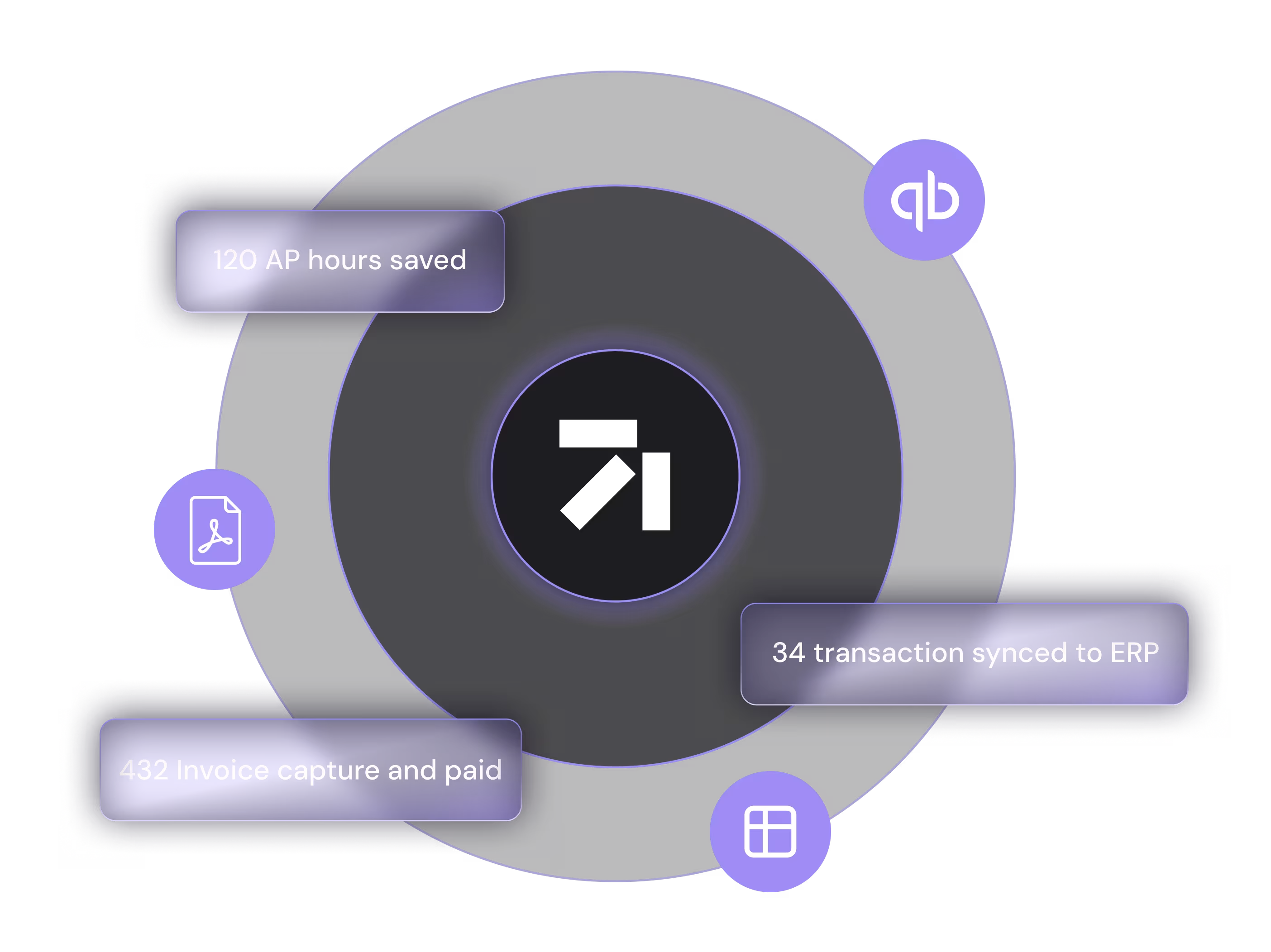

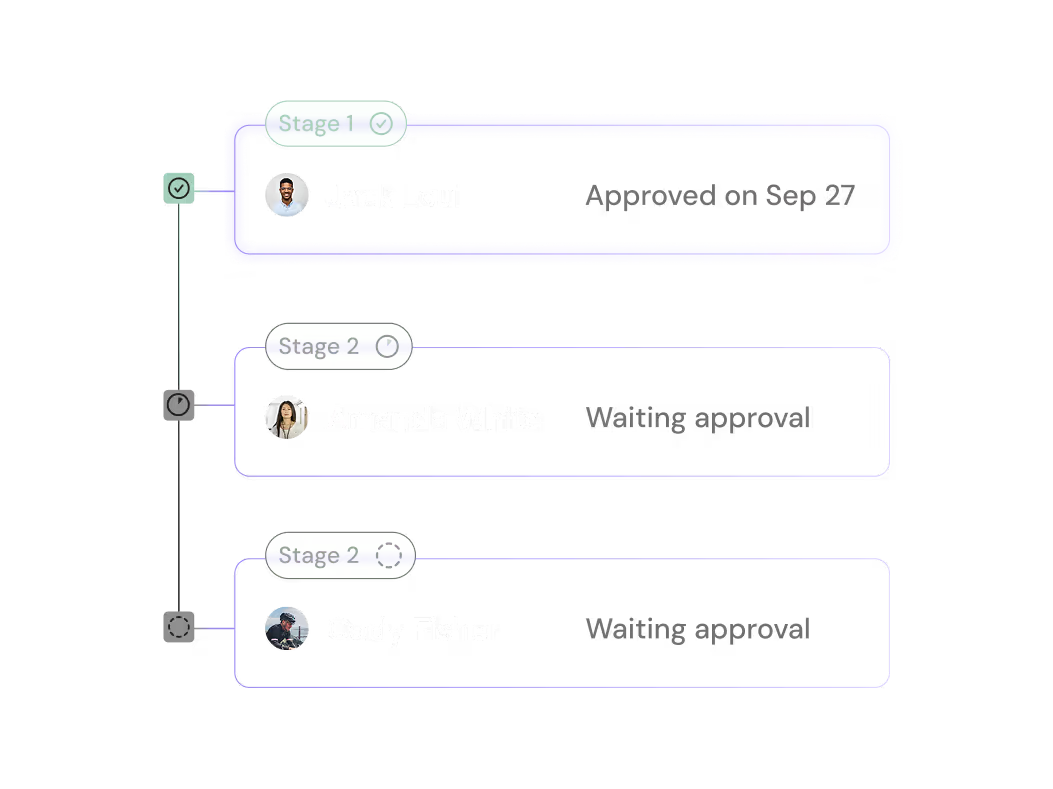

Automate ingestion, matching, approvals, and payments with full traceability built in.

Configurable workflows, line-level context, and role-based access ensure every decision is documented and compliant.

FFrom SOX-aligned approval chains to immutable audit logs, Finofo gives you complete visibility into every invoice, approval, code, and payment.

Audit cycles shrink from weeks to minutes.

Where strategic finance sees immediate returns.

Finofo routes global payments through local rails in 190+ countries — permanently removing expensive wire fees.

With policy-driven approvals, dual-auth controls, and real-time validations, payments are protected at every step.

See AP aging, FX exposure, and liabilities across all entities in one real-time dashboard — no toggling or reconciling required.

Access complete audit trails, approval logs, and transaction history instantly.

Everything is searchable, timestamped, and exportable.

Finofo works whether you’re running NetSuite, Intacct, or a spreadsheet.

Most AP systems stall until your ERP sends a PO or goods receipt.

Finofo doesn’t wait. It captures, classifies, and matches documents the moment they arrive so your team can move faster without breaking your existing stack.

Here’s what you get out of the box: